Course Schedule

Please note the following:

- Refer to the additional information section on the course schedule section details page for class meeting information.

- Courses sections listed as In-Person will be delivered via in-person class meetings.

- Course sections listed as Hybrid will be delivered using a combination of required in-person class meetings and eLearning or Zoom.

- Course sections listed as Online-Asynchronous will be delivered via the eLearning platform.

- Course sections listed as Online-Synchronous will meet remotely via Zoom.

To enroll in courses, you must either:

- be admitted to a degree or certificate program, or

- have submitted an open enrollment application

See also:

- Search the Course Catalog for courses not currently being offered

- View the Academic Calendar for important dates

- View GGU's Instruction Mode descriptions

BROWSE COURSES

BY SUBJECT

- Accounting

- Arts

- Business

- Business Analytics

- Communications

- Critical Thinking

- Data Analytics

- Doctor of Business Administration

- Economics

- English

- Executive Master of Business Administration

- Executive Master of Public Administration

- Finance

- History

- Human Resource Management

- Humanities

- Information Technology

BY LOCATION

SYLLABUS SEARCH

- To search for a syllabus click here then enter the course number. Syllabi are “in progress” and may not reflect the final copy. Final copies will be posted in eLearning.

Search Tips:

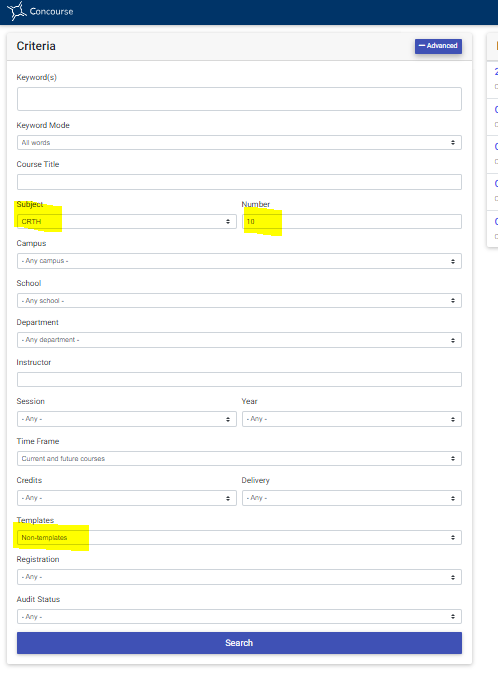

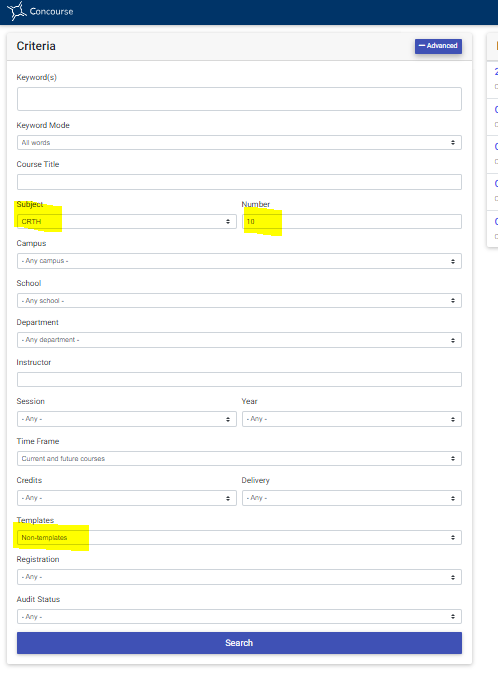

- Click on Advanced

- Select Subject and enter Course Number

- Select Non-templates and Search